Master Budgeting with Personal Finance Tools

- Andreea Harnagea

- Dec 29, 2025

- 3 min read

Updated: Jan 6

Why Use Personal Finance Tools?

Budgeting by hand or with basic spreadsheets can be time-consuming and prone to errors. Personal finance tools automate calculations and organize data efficiently. They provide insights that are hard to see otherwise. For example, they can show spending patterns, highlight unnecessary expenses, and suggest saving opportunities.

Using these tools saves time and reduces stress. They also help me stay disciplined by setting reminders and tracking progress. Whether managing household expenses or business finances, these tools adapt to different needs.

How Personal Finance Tools Improve Budgeting

Personal finance tools offer several benefits that improve budgeting:

Accuracy: They calculate totals and percentages automatically.

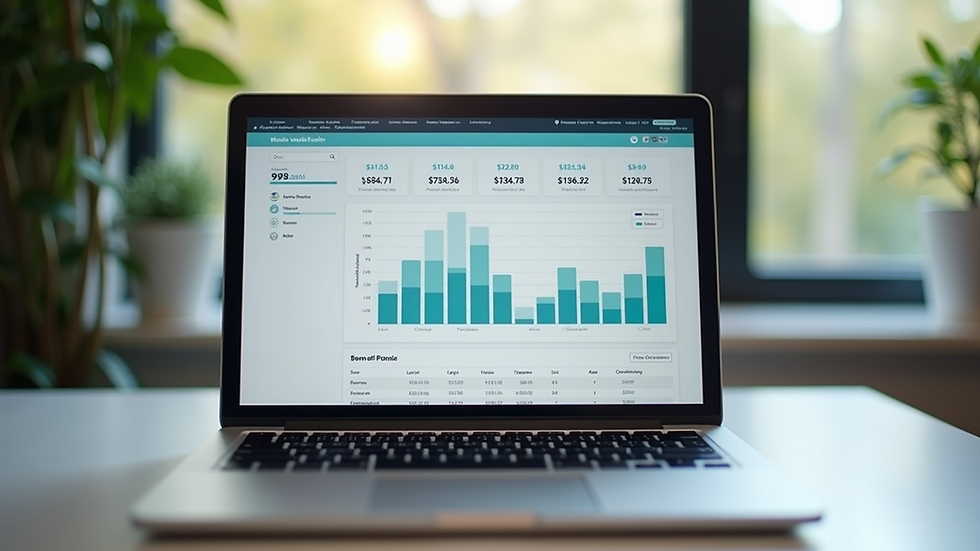

Visualization: Charts and graphs make it easier to understand spending habits.

Customization: I can set categories and limits that fit my lifestyle.

Forecasting: Some tools predict future expenses based on past data.

Goal Tracking: They help monitor savings goals and debt repayment.

For example, I use a tool that breaks down my monthly expenses into categories like groceries, utilities, and entertainment. It alerts me when I approach my budget limit in any category. This keeps me accountable and prevents overspending.

Choosing the Right Personal Finance Tools

Selecting the right tool depends on your specific needs. Here are some factors to consider:

Ease of Use: Choose tools with simple interfaces and clear instructions.

Features: Look for budgeting, expense tracking, and reporting capabilities.

Accessibility: Cloud-based tools allow access from multiple devices.

Security: Ensure the tool uses encryption and protects your data.

Cost: Many free options offer robust features; paid versions may add advanced functions.

I recommend trying a few free tools to see which one fits your style. Some tools also integrate with bank accounts to import transactions automatically, saving time.

How to Use Personal Finance Calculators Effectively

One powerful feature in many personal finance tools is the use of personal finance calculators. These calculators help estimate loan payments, savings growth, retirement needs, and more. Here’s how to use them effectively:

Input Accurate Data: Use real numbers for income, expenses, interest rates, and timelines.

Run Multiple Scenarios: Change variables to see how different choices affect outcomes.

Set Realistic Goals: Use calculator results to set achievable savings or debt repayment targets.

Review Regularly: Update inputs as your financial situation changes.

For example, I use a mortgage calculator to compare loan options before committing. This helps me understand how interest rates and loan terms impact monthly payments and total cost.

Tips for Maintaining Your Budget with Personal Finance Tools

Creating a budget is just the first step. Maintaining it requires discipline and regular review. Here are some tips:

Update Your Budget Weekly: Enter expenses and income regularly to keep data current.

Set Alerts: Use notifications to remind you of bill due dates and budget limits.

Review Reports Monthly: Analyze spending trends and adjust categories as needed.

Plan for Irregular Expenses: Include savings for annual or unexpected costs.

Use Multiple Tools: Combine budgeting apps with calculators and investment trackers for a full picture.

By following these steps, I stay on top of my finances and avoid surprises. The tools make it easier to spot issues early and adjust before problems grow.

Building Confidence in Financial Decisions

Using personal finance tools builds confidence. When I see clear numbers and projections, I make decisions without second-guessing. Whether it’s deciding to cut discretionary spending or invest extra savings, the data guides me.

These tools also help me communicate better with financial advisors or business partners. I can share reports and projections that support my plans. This transparency improves trust and collaboration.

Next Steps to Master Your Budget

Start by choosing a personal finance tool that fits your needs. Explore its features and try out the calculators. Set up your budget with realistic categories and limits. Track your spending consistently and review your progress monthly.

Remember, budgeting is a skill that improves with practice. The right tools make it easier and more effective. Use them to take control of your finances and reach your goals faster.

Conclusion

Master budgeting today with the help of personal finance tools. They simplify planning, increase accuracy, and empower you to make smart financial choices. With the right approach, I can confidently manage my finances and work towards my financial goals.

Comments